Navigating the New GSTR-9 and GSTR-9C Changes

The GST Annual Return (GSTR-9) and the Reconciliation Statement (GSTR-9C) serve as the final handshake between a taxpayer’s internal records and their monthly filings. For the Financial Year 2024-25, the government has introduced significant amendments aimed at eliminating ambiguity, improving reconciliation accuracy, and tightening the audit trail—especially concerning Input Tax Credit (ITC). Here is a […]

The Smart Choice for Small Business: Understanding the GST Composition Scheme

Starting a business is complex enough. Fortunately, the GST framework offers a simple, low-hassle option for small taxpayers: the Composition Scheme. It’s not just a registration type; it’s a strategic choice designed to minimize paperwork and reduce tax liability. If you run a local shop, a small manufacturing unit, or a standalone restaurant, here is […]

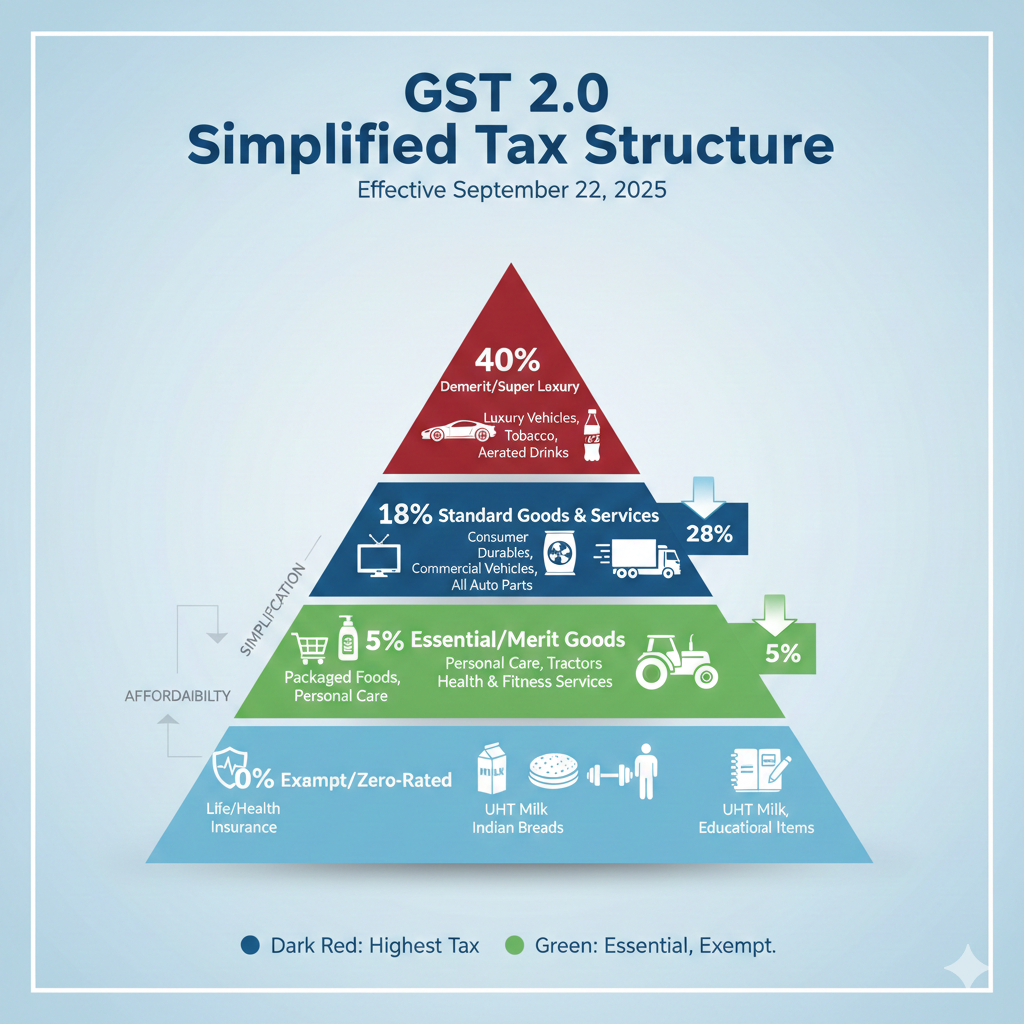

GST 2.0: What the New Two-Slab Structure Means (5% & 18%)

The shift to the new GST 2.0 structure primarily simplifies the tax regime from four main slabs (5%, 12%, 18%, 28%) to two key slabs: 5% (Merit Rate) and 18% (Standard Rate), plus a special high rate. The goal is to reduce the tax burden on everyday essentials, simplify compliance for businesses, and boost consumer […]

GST Simplified: Understanding ITC, Sales, Purchases, and Your Monthly Tax Bill

Navigating the world of Goods and Services Tax (GST) can feel like learning a new language. Terms like Input Tax Credit (ITC), outward supply, and inward supply are thrown around, leaving many business owners confused about what they actually owe to the government every month. Let’s break down these concepts with a simple example to […]

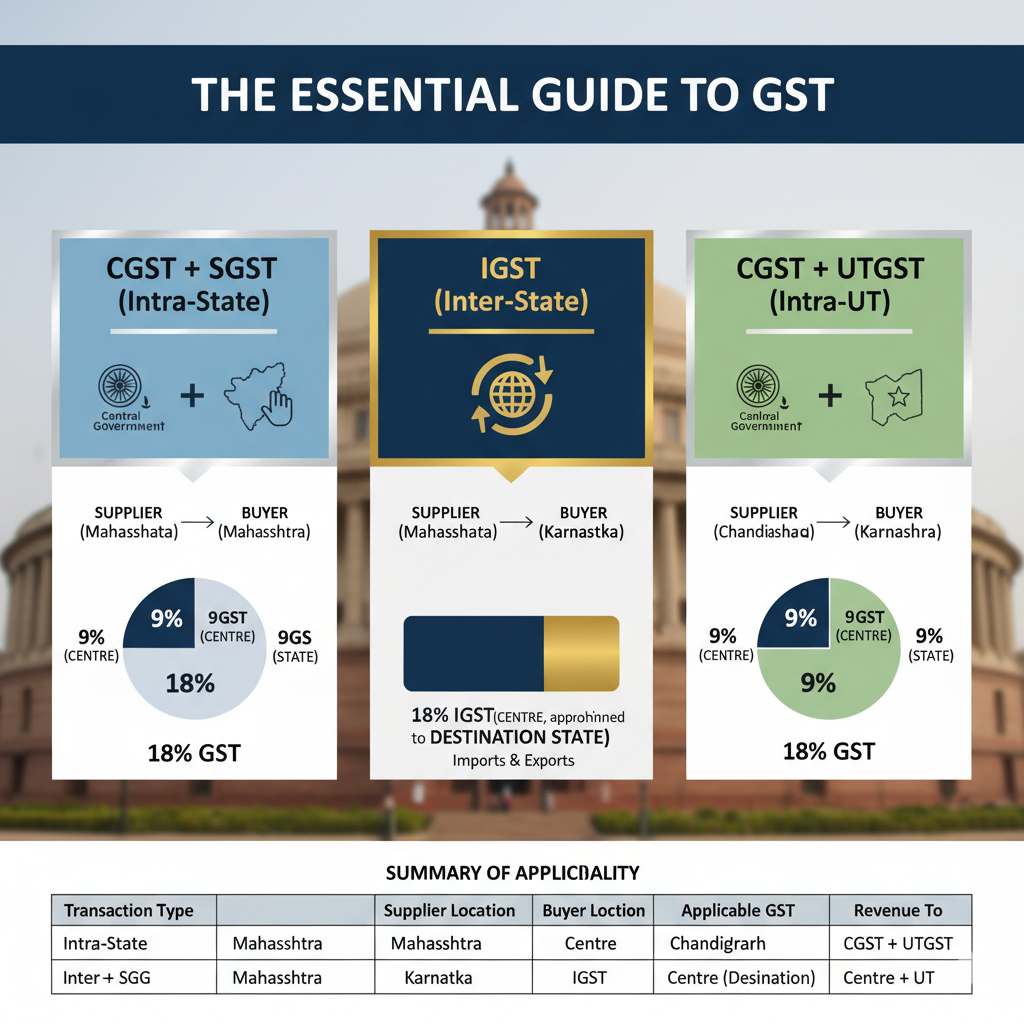

The Essential Guide to CGST, SGST, and IGST

India’s Goods and Services Tax (GST) system brought a simplified, unified tax regime, replacing a complex web of older indirect taxes. At the heart of this system are three key components: Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), and Integrated Goods and Services Tax (IGST). Understanding the differences between these […]

GST Basics Decoded: Taxable, Non-Taxable, Inward, Intra & Inter-State Supply

FORM 10IEA: THE KEY TO SWITCHING YOUR TAX REGIME FOR BUSINESS (DUPLICATE) Admin October 25, 2025 Understanding these five key terms is the first step to mastering GST. Let’s break them down with simple examples. 1. Taxable Supply This is the most common type of supply under GST. Simple Meaning: Any sale of goods or services […]

Ineligible ITC: A Simple Guide to What You CAN’T Claim

Ever wondered if you can claim back all the GST you pay on business purchases? The answer is no. Understanding Ineligible ITC is crucial to avoid costly mistakes and penalties. Let’s break it down in the simplest way possible. What is Ineligible ITC? Think of Input Tax Credit (ITC) as a discount you get on the tax you’ve already […]

YOUR WALLET JUST GOT LIGHTER: GST Rate Cuts Kick In From September 22nd

Mark September 22nd on your calendar – it’s the day your everyday expenses became significantly lighter! The government has announced sweeping GST revisions that target everything from your weekend getaways to your daily grocery shopping. These aren’t just minor adjustments; they’re substantial cuts designed to provide immediate relief to consumers across the board. Let’s explore […]

GST Update: Key Changes You Need to Know (Aug-Sept)

Keeping up with GST changes is crucial for businesses and consumers alike. Recent updates have brought clarity and revised rates on several common goods and services. A common question is: do all changes fall under 5% or 18%? The answer is no—the updates span various rates to address specific sector needs. Here’s a quick, […]

GST Guide: Don’t Mix Up “0% Rate and “Nil Rate” Supplies

If you’re navigating the world of GST in India, you’ve likely come across the terms “0% rate” and “Nil rate.” At first glance, they seem identical—both mean no tax is paid by the customer. So, why does GST make a distinction? Aren’t they the same thing? This is one of the most common areas of confusion for […]